Central Texas Housing Market Update – Year-End 2025

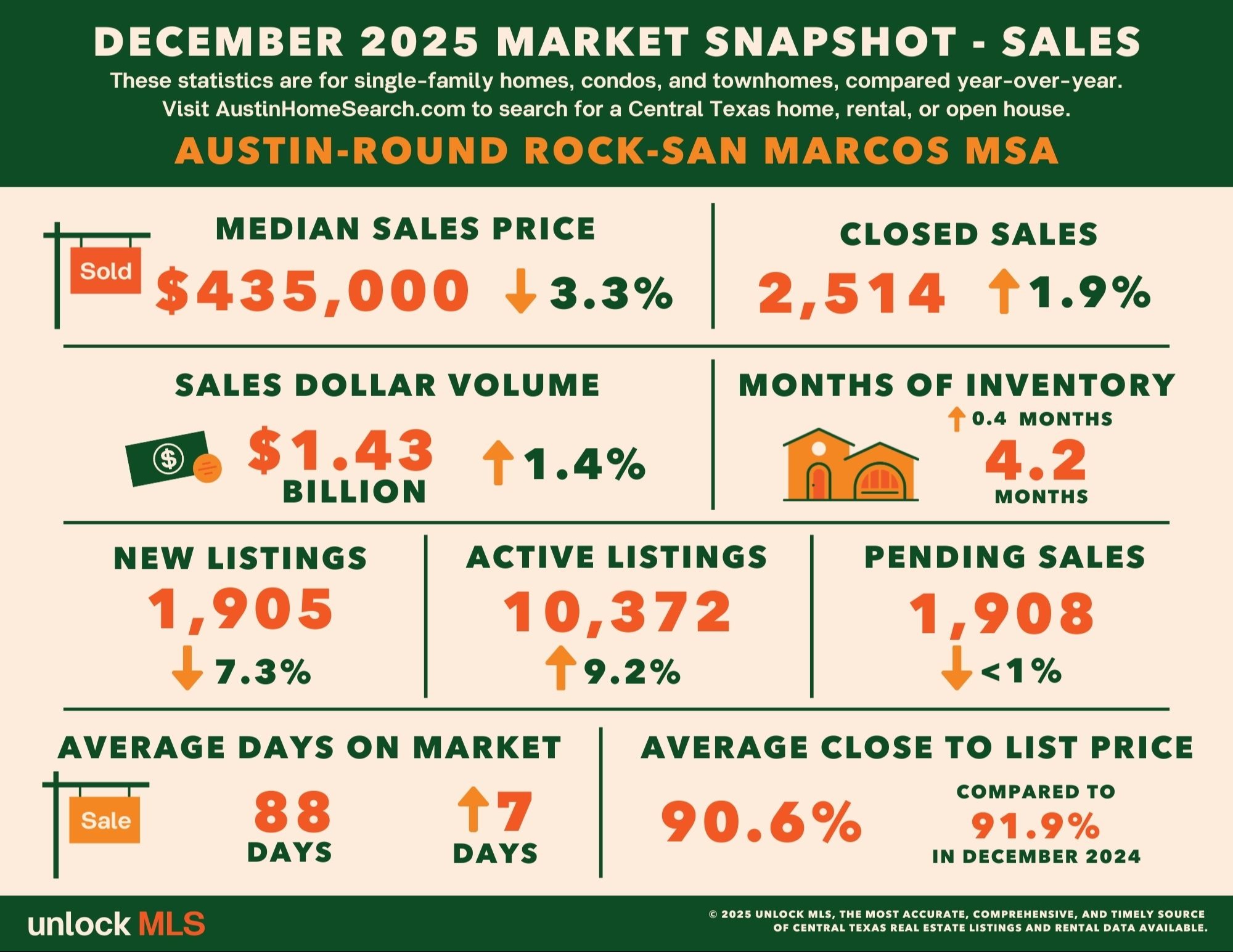

In 2025, while closed sales across the Central Texas MSA dipped 3.2% to 29,383 transactions, buyer activity gained traction in the second half of the year as pricing continued to normalize and inventory settled after peaking midyear. These trends reflect a market that recalibrated and moved toward greater balance and predictability.

Vaike O’Grady, research advisor at Unlock MLS, noted that December 2025 data mirrored broader behavioral shifts in the market, reflecting how both buyers and sellers adjusted their approach throughout the year to navigate changing conditions more successfully.

As the year progressed, sellers recalibrated expectations, buyers reengaged, and overall market pace normalized. December 2025 figures confirmed that shift, with more than 2,500 closed home sales — an increase compared to December 2024 — even as buyers moved more deliberately and pricing remained realistic.

Looking ahead to 2026, experts anticipate continued stability in the Central Texas housing market. Mortgage rates are projected to remain near 6%, with home sales and prices expected to hold relatively flat. At the same time, improving affordability and a resilient local job market position the region to weather broader national uncertainty and support gradual, sustainable growth.

2025 reinforced that success in today’s housing market isn’t simply about timing. Preparation, strategy, and trusted guidance remain key factors in navigating evolving conditions.